news, people, new vacuum pumps, mergers and acquisition

to the latest news

Pfeiffer Vacuum OnTool™ Booster wins 'R&D 100 Award' Asslar, Deutschland, Oct. 19, 2007 Pfeiffer Vacuum has won the prestigious “R&D 100 Award” for developing the OnTool Booster. mehr |

KNF NPK04 Compact Mini Swing-Piston Vacuum Pump July 28, 2007 Available in compressor or vacuum pump models, Model NPK04 can be operated in any position and can be used as air/gas transfer pump in medical applications. Sealed, swing piston moves media oil-free and without adding contamination. Featuring 3.3 lpm of free flow, pump provides max vacuum of 21.6 in. Hg or max pressure of 31 psig. more |

SKF acquires magnetic bearing manufacturer S2M Göteborg, den 27. Juli 2007 SKF, the knowledge engineering company, has expanded its bearings business still further with the acquisition of S2M, a major European manufacturer of specialised magnetic bearings and motors for use in a wide range of demanding applications. SKF has purchased the S2M business from UK based Edwards Limited, by increasing its existing shareholding of 12% in S2M to 100% with an investment of approximately 55 million Euros (£37 million). mehr |

Gardner Denver, Inc. Reports Record Results for the Second Quarter of 2007 QUINCY, Ill., Jul. 25, 2007 "Gardner Denver achieved a new record in revenues and net income during the second quarter," said Ross J. Centanni, Chairman, President and CEO of Gardner Denver. ... In the second quarter of 2007, Compressor and Vacuum Products segment revenues grew 9 percent compared to the second quarter of 2006. more |

BOC Edwards Now Edwards

BOC Edwards Now Edwards

July 17, 2007 Following our change of ownership in June when we parted company from BOC and The Linde Group, we are pleased to announce our ‘new’ branding which, as you can see, is Edwards. We are also pleased to announce our executive management team, each with regional responsibility to further strengthen our local presence and ensure customer satisfaction. more |

Graham Corporation Wins Record $9.5 Million Vacuum System Order

Graham Corporation Wins Record $9.5 Million Vacuum System Order

Graham Corporation, Batavia (NY) USA, July 9, 2007 BATAVIA, NY, July 9, 2007 – Graham Corporation (AMEX: GHM) announced today that it has been awarded a $9.5 million purchase order for an ejector/liquid ring pump combination vacuum system for a major U.S. refinery expansion project located in the U.S. Gulf Coast region. more |

New Catalogue - Oerlikon Leybold Vacuum General Catalogue Cologne, 28. Juni 2007 Oerlikon Leybold Vacuum new general catalogue is now available. The 980-page volume contains everything that users and interested parties ought to know about Vacuum Technology and Oerlikon Leybold vacuum's product line. more |

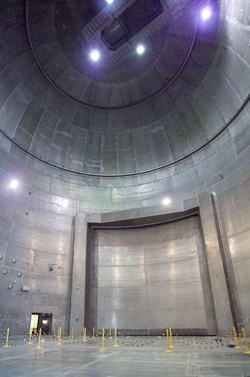

World's Largest Vacuum Chamber to Test Orion

World's Largest Vacuum Chamber to Test OrionJune 19, 2007 - NASA's Glenn Research Center Before NASA's new spacecraft, Orion, carries the next generation of explorers into space, it first will make a shorter journey to the world's largest vacuum chamber. In this massive, cathedral-like structure, it must endure a variety of rigorous challenges. Called the Space Power Facility, the vacuum chamber resides at NASA Glenn Research Center's Plum Brook Station in Sandusky, Ohio. It measures 100 feet in diameter and towers at 122 feet tall. Its immense size and ability to simulate the vacuum of space make it ideal for testing the Orion crew exploration vehicle. more Image left: Inside the Space Power Facility at Plum Brook Station. Credit: NASA |

Innovative Scroll Pump from Varian, Inc.

Innovative Scroll Pump from Varian, Inc. - a Compact Solution to the Difficult Problem of Dry Vacuum Pumping June 11, 2007 Varian, Inc. (Nasdaq: VARI) announced today its new compact, high performance, dry scroll pump. The innovative IDP-3 brings the proven benefits of dry scroll technology to applications where vacuum performance, pump size and environmental concerns are critical. The IDP-3 employs a hermetic design in which the motor and bearings are outside the vacuum space, allowing full isolation of all pumped gases. more |

Graham Corporation Achieves Fourth Quarter Record Earnings and 2007 Year-End Backlog

Graham Corporation Achieves Fourth Quarter Record Earnings and 2007 Year-End Backlog

Graham Corporation, Batavia (NY) USA, June 5, 2007 Graham Corporation (AMEX: GHM) today reported record earnings and an increase driven by continued strong demand for Graham’s vacuum systems and surface condensers for refineries and petrochemical processing plants. For the full fiscal year, sales were $65.8 million compared with $55.2 million in fiscal year 2006. more |

Changes in the Management Board at Pfeiffer Vacuum Technology AG

Changes in the Management Board at Pfeiffer Vacuum Technology AG

Pfeiffer Vacuum Technology AG, June 1st, 2007 Wolfgang Dondorf (63), who has served as the chief executive officer of Pfeiffer Vacuum Technology AG since its formation in 1996, will be stepping down from this post at his own request effective June 30, 2007. Former Chief Financial Officer Manfred Bender has been appointed as the new chief executive officer. more |

|

ANGSTROM SCIENCES appoints new sales manager

Pittsburgh, PA, April 25, 2007 Angstrom Sciences, Inc. today announced the appointment of Mark J. Seeman to the position of Sales Manager. more |

COMVAC 2007

April 17, 2007

|

It was a pleasure to meet all in Hannover !

|

Linde sells BOC Edwards' vacuum to buyout specialist

Linde sells BOC Edwards' vacuum to buyout specialist

Mar. 12, 2007 BOC Edwards is pleased to announce that our equipment business has been acquired by CCMP Capital, the premier global private equity firm, through their affiliates CCMP Capital Advisors LLC and CCMP Capital Asia. The contract was signed today and will come into effect on approval from the relevant anti-trust authorities and the fulfilment of the usual closing conditions. more |

SCHWARZER PRECISION SP 135 FZ – worldwide smallest vane pump

SCHWARZER PRECISION SP 135 FZ – worldwide smallest vane pump

Jan. 3, 2007 Because of the almost pulsation-free pumping process the SP 135 FZ is ideal for applications in respiratory gas analysis. more |

Pfeiffer Vacuum OnTool™ Booster wins 'R&D 100 Award'

Asslar, Deutschland,Oct. 19, 2007

Award-winning: The OnTool™ Booster innovation. Pfeiffer Vacuum has won the prestigious “R&D 100 Award” for developing the OnTool Booster. R&D Magazin awards this prize annually in recognition of the 100 most technologically significant new developments. Development director Armin Conrad had this to say in accepting the prize on October 18, 2007: “We are very pleased about this distinction. Pfeiffer Vacuum has brought to market a high-vacuum pump that works against atmosphere. In the past, many applications required the employment of a combination of high-vacuum and backing pumps. This vacuum pump sets new standards. Since the new OnTool Booster works against atmosphere, a backing pump is no longer required. Due to the compact design, the pump can be placed directly at the vacuum chamber. That saves space and money for our customers.”

Pfeiffer Vacuum GmbH

Sabine Trylat, Public Relations, email: Sabine.Trylat@pfeiffer-vacuum.de, Tel. +49 (0) 6441 802-169, Fax +49 (0) 6441 802-883

KNF NPK04 Compact Mini Swing-Piston Vacuum Pump

Juli 28, 2007

KNF announces its newest addition to its OEM swing-piston pump line, the NPK04. The NPK04 is ideal for use in medical devices as an air/gas transfer pump, is available in compressor or vacuum pump models and can be operated in any position. Its sealed, swing piston moves media oil-free and without adding contamination. Despite its size, it features 3.3 liters per minute of free flow, and is available in an optimized version for vacuum (max. 21.6 in. Hg) or pressure (max 31 psig) generation. Two motor options include standard DC or an economical brushless-dc motor. The BLDC model is only 2.5 in. long, is available with optional logic speed control interface and features low EMI/RFI. The pump is maintenance-free, very quiet, and exhibits low vibration, low current and power consumption, making it ideal for mobile, battery-powered applications. All standard KNF pumps can be customized to meet specific OEM performance requirements. It is suitable for use in medical and analytical instruments, ink-jet printers, and pneumatic supply functions such as ergonomic therapy furniture.

www.knf.com

SKF acquires magnetic bearing manufacturer S2M

Göteborg, Juli 27, 2007

SKF, the knowledge engineering company, has expanded its bearings business still further with the acquisition of S2M, a major European manufacturer of specialised magnetic bearings and motors for use in a wide range of demanding applications. SKF has purchased the S2M business from UK based Edwards Limited, by increasing its existing shareholding of 12% in S2M to 100% with an investment of approximately 55 million Euros (£37 million).

Founded in 1976 and now with an annual turnover of around £27 million, S2M has its headquarters and manufacturing centre in France, where the company employs around 200 people in the design, development and production of highly specialised magnetic bearings and high speed motors. These are based on a combination of proven electromagnetic principles and precise sensor and servo-control technologies, creating products that are extremely energy efficient, reliable and capable of offering an extremely long operating life even under arduous conditions.

In particular, the company's latest contact-free magnetic bearings are used in a variety of technically and environmentally challenging applications that include vacuum pumps, small air and gas compressors, turbo expanders and compressors for the oil and gas, semi-conductor and aerospace industries.

SKF's chief executive, Tom Johnstone, explains that the electromagnetic technologies developed by S2M are, "Extremely interesting and fast developing. In recent years these have grown from their development phase and are now considered a reliable option in many different applications. The acquisition will therefore give SKF access to a new and exciting range of products that complement our existing magnetic, plain, ball and rolling bearings, and bearing units and housings".

Tom Johnstone added that the acquisition of S2M, "Strengthens still further our position as the world's largest manufacturer of bearings and, more importantly, means that we can offer our customers an even wider range of specialised products, backed by the expertise and knowledge of a worldwide team of team of industry experts and dedicated technical support engineers".

S2M will become part of SKF's Industrial Division. The acquisition is subject to approval by the relevant authorities.

www.skf.com

For details contact: Phil Burge, Tel. +44 (0)1582 496433

Gardner Denver, Inc. Reports Record Results for the Second Quarter of 2007

QUINCY, Ill., July 25 Gardner Denver, Inc. (NYSE: GDI) announced that revenues and net income for the three months ended June 30, 2007 were $459.9 million and $44.8 million, respectively. For the six-month period of 2007, revenues and net income were $901.3 million and $87.6 million, respectively. Diluted earnings per share ("DEPS") for the three months ended June 30, 2007 were $0.83, 34 percent higher than the comparable period of 2006. For the six-month period of 2007, DEPS were $1.63, 37 percent higher than the comparable period of the previous year. The DEPS improvement is primarily attributable to the incremental flow-through profitability of organic revenue growth, operational improvements, including the benefits from acquisition integration, and a lower effective tax rate.

Revenue Growth and Cost Reductions Drive Higher Earnings and Cash Provided by Operating Activities

Company Raises Full-Year DEPS Outlook Range to $3.10 to $3.18

Compared to the Second Quarter of 2006:

- Revenues increased 10 percent

- Net income increased 36 percent

- Diluted earnings per share increased 34 percent

Cash provided by operating activities exceeded $54 million in the six-month period of 2007, compared to $23 million in the same period of 2006

CEO's Comments Regarding Results

"Gardner Denver achieved a new record in revenues and net income during the second quarter," said Ross J. Centanni, Chairman, President and CEO of Gardner Denver. "Year-over-year, we continued to expand the Company's total segment operating earnings(1) as a percentage of revenues (segment operating margin(1)) and net income grew more than three times faster than revenues. We continued to realize the benefit of some of our integration activities and have initiated additional cost reduction programs in Europe. I believe reductions in inventory will be realized in the second half of 2007 as we continue our focus on lean manufacturing initiatives and business process improvements.

"In the second quarter of 2007, Compressor and Vacuum Products segment revenues grew 9 percent compared to the second quarter of 2006. Sequentially, organic growth accelerated as we resolved some manufacturing inefficiencies associated with our acquisition integration initiatives. We continued to see strong demand outside of the United States, particularly in Europe and Asia, while year-over-year orders and revenues were relatively flat in the United States, as expected, primarily due to lower demand for transportation applications.

"Although we made improvements during the second quarter, we believe manufacturing plant relocations in Europe negatively impacted orders and production efficiency during the quarter. As I stated last quarter, we expect this effect to be temporary. Furthermore, year-over-year comparisons in Compressor and Vacuum Products segment orders were negatively impacted by a reporting change to exclude some OEM orders with delivery times beyond 90 days, which was implemented in the fourth quarter of 2006.

"Fluid Transfer Products segment revenues grew 16 percent in the second quarter of 2007, compared with the second quarter of 2006," said Mr. Centanni. "Orders grew 13 percent in the second quarter due to our receipt of certain contracts for liquid natural gas and compressed natural gas loading arms to be shipped in the first half of 2008. These orders more than offset the expected decline in orders for drilling pumps, compared to the same period of the previous year."

Commenting on profitability initiatives, Mr. Centanni stated, "Our previously announced integration projects remain substantially on schedule, while additional profitability improvement projects were initiated in the second quarter. Our product line transfers from Nuremberg, Germany to China and Brazil were substantially completed during the second quarter. Labor productivity and supply chain efficiencies are now being realized, which are expected to result in annualized savings of approximately $3 million. Approximately $0.3 million of this benefit was realized in the second quarter of 2007.

"The manufacturing integration of the Schopfheim, Germany facilities also continues as planned," said Mr. Centanni. "Upon the completion of the manufacturing upgrade, process improvements are expected to increase productivity, while reducing lead-times and inventory. The project is expected to be completed by the end of the fourth quarter of 2007 and generate cost savings of approximately $6.4 million annually.

"We continue to seek opportunities to reduce costs and sell excess assets as we further streamline operations. In the second quarter of 2007, we relocated assembly operations from Hesingue, France to our facility in Schopfheim. We expect to sell the Hesingue property in the third quarter of 2007. We also began integrating other administrative functions in Europe during the second quarter of 2007, resulting in severance expenses of $0.4 million.

"As a result of our continued improvement in profitability and asset management, our annualized return on equity (defined as net income divided by average equity) improved to 19.1 percent in the second quarter of 2007, compared to 17.6 percent for the full-year 2006."

Outlook

"As we consider the second half of 2007, we anticipate demand for our industrial equipment to remain strong in Europe and Asia and relatively flat in the U.S. We expect future organic revenue and earnings growth based on our current backlog and improving manufacturing execution of production schedules. We continue to see potential opportunities in environmental applications around the world, including flue gas desulfurization and flare gas and wastewater treatment," said Mr. Centanni.

"In the Fluid Transfer Products segment, orders for well servicing pumps accelerated in the second quarter compared to the first quarter of 2007. However, the number of drilling pumps in backlog is less than at this time last year and we anticipate declining shipments for the balance of the year. As drilling pump shipments decline in the second half of 2007, we expect somewhat lower Fluid Transfer Products segment operating margin(1) to result from the unfavorable mix and reduced volume leverage. The deterioration in margin is expected to be somewhat mitigated, however, by ongoing demand for well servicing pumps and aftermarket parts and our ability to bring previously outsourced manufacturing in-house," said Mr. Centanni.

"Given our current economic outlook, existing backlog, expected operational improvements from integration projects, and lower effective tax rate, we are raising our full-year 2007 DEPS outlook range to $3.10 to $3.18. Third quarter DEPS is expected to be $0.72 to $0.77. Our outlook for the third quarter assumes fewer production days due to holidays in Europe and scheduled manufacturing shutdowns in the U.S. The midpoint of the DEPS range for the third quarter of 2007 ($0.75) represents a 25 percent increase over the same period of 2006. The midpoint of the new DEPS range for the full-year 2007 ($3.14) represents a 26 percent increase over 2006 results. Based on current expectations, the effective tax rate assumed in the DEPS guidance for the third and fourth quarters of 2007 is 31 percent."

The stated guidance above excludes the effect of a recently announced German corporate tax rate reduction, which was enacted in the third quarter of 2007 and will become effective beginning January 1, 2008. The Company anticipates a non-recurring, non-cash reduction to deferred tax liabilities of $8 million to $12 million related to this effective tax rate change, which will be recognized in the third quarter of 2007 and reduce income tax expense during the quarter by the same amount. Guidance for the Company's expected tax rate for 2008 will be included in the Company's earnings release for the third quarter of 2007.

Revised Presentation of Operating Results for the Reporting of Depreciation and Amortization Expenses

Beginning in the first quarter of 2007, the Company's presentation of its operating results reflects the inclusion of depreciation and amortization expense in cost of sales and selling and administrative expenses. Total depreciation and amortization was previously reported as a separate caption in the consolidated statements of operations. The 2006 consolidated statements of operations included in this press release have been reclassified to conform to the current presentation. Depreciation and amortization expense included in cost of sales and selling and administrative expense for the three months ended June 30, 2006 was approximately $12.3 million and $2.2 million, respectively. For the six months ended June 30, 2006, depreciation and amortization expense included in cost of sales and selling and administrative expense was approximately $19.7 million and $6.8 million, respectively. This reclassification had no effect on reported consolidated income before tax, net income, per share amounts, reportable segment operating earnings(1) or cash provided by operating activities.

Second Quarter Results

Revenues increased $43.6 million (10 percent) to $459.9 million for the three months ended June 30, 2007, compared to the same period of 2006. Compressor and Vacuum Products segment revenues increased 9 percent for the three-month period of 2007, compared to the previous year, driven by organic growth in most product lines and favorable changes in currency exchange rates. Fluid Transfer Products segment revenues increased 16 percent for the three months ended June 30, 2007, compared to the same period of 2006, primarily resulting from increased volume in well servicing pumps (see Selected Financial Data Schedule).

Compressor and Vacuum Products orders of $358.1 million for the three-month period ended June 30, 2007 were $13.8 million (4 percent) higher than the same period of the previous year due to favorable changes in exchange rates. Orders for Fluid Transfer Products of $125.1 million for the three months ended June 30, 2007 were $14.7 million (13 percent) higher than the same period of the previous year due to the loading arm orders mentioned previously, partially offset by declining demand for drilling pumps.

Cost of sales as a percentage of revenues improved to 66.5 percent in the three-month period ended June 30, 2007, from 67.7 percent in the same period of 2006. Cost of sales in the three-month period of 2006 was impacted by a non-recurring charge to depreciation expense of approximately $4.1 million associated with the finalization of the fair market value of Thomas Industries' property, plant, and equipment. The year-over-year decrease in cost of sales as a percentage of revenues was also attributable to cost reduction initiatives, leveraging fixed and semi-fixed costs over additional production volume, and favorable sales mix. The second quarter of 2007 included a higher percentage of well servicing pump shipments than the previous year and these products have cost of sales percentages below the Company's average.

As a percentage of revenues, selling and administrative expenses improved to 17.9 percent for the three-month period ended June 30, 2007, compared to 18.1 percent for the same period of 2006, as a result of cost control initiatives and leveraging revenue growth. Selling and administrative expenses increased $7.0 million in the three-month period ended June 30, 2007 to $82.3 million, as compared to the same period of 2006. Approximately $2.4 million of the increase is attributable to a non-recurring reduction to amortization expense in the three-month period of 2006 associated with the finalization of the fair market value of Thomas Industries' amortizable intangible assets. Unfavorable changes in foreign currency exchange rates resulted in an increase of approximately $3.1 million in the three-month period of 2007, compared to the previous year. The Company also recognized approximately $0.4 million of planned restructuring costs related to the consolidation of certain administrative functions in Europe during the second quarter of 2007. The remaining increase in selling and administrative expenses is primarily due to compensation and benefit expense increases. These increases were partially offset by cost reductions realized through integration initiatives.

Segment operating earnings(1) as a percentage of revenues (segment operating margin(1)) for the Compressor and Vacuum Products segment were 11.7 percent in the three months ended June 30, 2007, compared with 10.4 percent in the same period of 2006. The Fluid Transfer Products segment generated segment operating margin(1) of 28.6 percent in the three months ended June 30, 2007, an improvement from 27.8 percent in the second quarter of 2006 and a new record level for this reportable segment despite the decline in drilling pump shipments. The improved results for each reportable segment reflect significant leveraging of fixed and semi-fixed costs over higher revenues and cost reductions realized to date through acquisition integration initiatives. Price increases and favorable product mix resulting from the increased sales of well servicing pumps also contributed to the improved operating margin for the Fluid Transfer Products segment.

Interest expense decreased $2.7 million (28 percent) to $6.9 million for the three months ended June 30, 2007, compared to the same period of 2006, due to significantly lower borrowing levels.

Net income for the three months ended June 30, 2007 increased $11.8 million (36 percent) to $44.8 million, compared to $33.0 million in same period of 2006. DEPS for the three-month period of 2007 were $0.83, 34 percent higher than the comparable period of the previous year as a result of the increased net income. These financial results reflect an effective tax rate of 31.0% for the three-month period of 2007, compared to 33.9% for the three-month period of 2006.

Six Month Results

Revenues for the first six months of 2007 increased $85.7 million (11 percent) to $901.3 million, compared to $815.6 million in the same period of 2006. This increase resulted from organic growth and favorable changes in foreign currency exchange rates. Incremental volume and the related benefit of increased cost leverage over a higher revenue base, and favorable sales mix, resulted in improved cost of sales as a percentage of revenues, which decreased to 66.4 percent in the first six months of 2007, compared with 67.3 percent in the same period of 2006. Cost of sales in the six-month period of 2006 was negatively impacted by the previously mentioned non-recurring increase in depreciation expense of approximately $4.1 million associated with the finalization of the fair market value of Thomas Industries' property, plant, and equipment. Declines in productivity related to acquisition integration efforts partially offset these improvements (see Selected Financial Data Schedule).

As a percentage of revenues, selling and administrative expenses improved to 18.1 percent for the first six months of 2007, from 18.8 percent in the comparable period of 2006, as a result of cost control initiatives and leveraging revenue growth. Selling and administrative expenses increased $9.6 million for the six-month period ended June 30, 2007 to $163.2 million, primarily due to unfavorable changes in foreign currency exchange rates ($6.8 million) and the $2.4 million non-recurring reduction to amortization expense in the six-month period of 2006 mentioned previously. Higher compensation and benefit costs were largely offset by cost reductions realized through integration initiatives.

Interest expense decreased $6.2 million (31 percent) to $13.6 million in the six-month period of 2007, compared to the same period of 2006, due to lower average borrowings during the period.

Income taxes increased for the six months ended June 30, 2007, compared to the same period of the previous year, due to higher pretax income, partially offset by a lower effective tax rate for the six-month period of 2007 (30.9 percent) than in the same period of 2006 (33.0 percent).

Net income increased $24.1 million (38 percent) to $87.6 million for the six months ended June 30, 2007, compared to $63.5 million for the same period of 2006. Diluted earnings per share for the six-month period of 2007 were $1.63, 37 percent higher than the same period of previous year.

Cash provided by operating activities was approximately $54 million in the six-month period of 2007, compared to approximately $23 million in the same period of 2006. The increase in cash provided by operating activities primarily reflects higher net income. The Company experienced an increase in days sales outstanding for the second quarter of 2007, primarily due to changes in product mix. Shipment delays and supply chain inefficiencies continued to negatively impact inventory turnover, which declined to 4.7 times in the three-month period of 2007 from 4.9 times in the comparable period of 2006. The Company believes opportunities for inventory reduction exist through the expanded use of lean manufacturing techniques, supply chain improvements, improved manufacturing efficiency as integration initiatives are completed and consumption of inventory previously positioned to avoid disruptions during the recent manufacturing relocations.

The Company invested approximately $17.9 million in capital expenditures during the six-month period of 2007, compared to $16.1 million in the same period of 2006. For the full-year 2007, capital spending is expected to be approximately $45 million to $50 million. Depreciation and amortization expense was approximately $27.9 million for the six months ended June 30, 2007, compared to $26.5 million in the six-month period of 2006.

Total debt as of June 30, 2007 was $367.7 million, $39.5 million less than total debt as of December 31, 2006. As of June 30, 2007, debt to total capital was 27.4 percent, compared to 32.3 percent on December 31, 2006 and 42.0 percent on June 30, 2006.

Cautionary Statement Regarding Forward-Looking Statements

All of the statements in this release, other than historical facts, are forward-looking statements made in reliance upon the safe harbor of the Private Securities Litigation Reform Act of 1995, including, without limitation, the statements made under the "CEO's Comments Regarding Results," "Outlook," "Second Quarter Results" and "Six Month Results" sections. As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations, and beliefs relating to matters that are not historical in nature. Such forward-looking statements are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the control of the Company. These uncertainties and factors could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements.

The following uncertainties and factors, among others, could affect future performance and cause actual results to differ materially from those expressed in or implied by forward-looking statements: (1) the Company's exposure to economic downturns and market cycles, particularly the level of oil and natural gas prices and oil and natural gas drilling production, which affect demand for Company's petroleum products, and industrial production and manufacturing capacity utilization rates, which affect demand for the Company's compressor and vacuum products; (2) the risks of large or rapid increases in raw material costs or substantial decreases in their availability, and the Company's dependence on particular suppliers, particularly iron casting and other metal suppliers; (3) the risks associated with intense competition in the Company's markets, particularly the pricing of the Company's products; (4) the ability to effectively integrate acquisitions, including product and manufacturing rationalization initiatives, and realize anticipated cost savings, synergies and revenue enhancements; (5) the ability to attract and retain quality executive management and other key personnel; (6) the ability to continue to identify and complete other strategic acquisitions and effectively integrate such acquisitions to achieve desired financial benefits; (7) economic, political and other risks associated with the Company's international sales and operations, including changes in currency exchange rates (primarily between the U.S. dollar, the Euro, the British pound and the Chinese yuan); (8) the risks associated with potential product liability and warranty claims due to the nature of the Company's products; (9) the risks associated with environmental compliance costs and liabilities; (10) the risks associated with pending asbestos and silicosis personal injury lawsuits; (11) risks associated with the Company's indebtedness and changes in the availability or costs of new financing to support the Company's operations and future investments; (12) the risks associated with enforcing the Company's intellectual property rights and defending against potential intellectual property claims; (13) the ability to avoid employee work stoppages and other labor difficulties; (14) changes in discount rates used for actuarial assumptions in pension and other postretirement obligation and expense calculations and market performance of pension plan assets; and (15) the risk of possible future charges if the Company determines that the value of goodwill and other intangible assets, representing a significant portion of its total assets, is impaired. The Company does not undertake, and hereby disclaims, any duty to update these forward-looking statements, although its situation and circumstances may change in the future.

Comparisons of the financial results for the three and six-month periods ended June 30, 2007 and 2006 follow.

Gardner Denver will broadcast a conference call to discuss second quarter earnings on Thursday, July 26, 2007 at 9:30 a.m. Eastern time through a live webcast. This free webcast will be available in listen-only mode and can be accessed, for up to ninety days following the call, through the Investor Relations page on the Gardner Denver website (http://www.gardnerdenver.com) or through Thomson StreetEvents at http://www.earnings.com.

Gardner Denver, Inc., with 2006 revenues of $1.7 billion, is a leading worldwide manufacturer of reciprocating, rotary and vane compressors, liquid ring pumps and blowers for various industrial and transportation applications, pumps used in the petroleum and industrial markets, and other fluid transfer equipment serving chemical, petroleum, and food industries. Gardner Denver's news releases are available by visiting the Investor Relations page on the Company's website (http://www.gardnerdenver.com).

download the press release

For more information contact:

Gardner Denver, Inc. - www.gardnerdenver.com - 20 Florence Avenue Batavia, NY 14020, USA

Christian E. Rothe,Director, Strategic Planning and Development of Gardner Denver, Inc., Tel. +1-217-228-8224

BOC Edwards Now Edwards

July 17, 2007

Dear Valued Customer,

Welcome to the new Edwards!

Following our change of ownership in June when we parted company from BOC and The Linde Group, we are pleased to announce our ‘new’ branding which, as you can see, is Edwards. Of course, this name is not new as it has always been part of our name since we were founded by F. D. Edwards in 1919, and what we have been known as in the semiconductor and wider vacuum industries.

This is an exciting time for Edwards and our new owners, CCMP Capital, representing far more than just a new logo. As a newly-independent, privately-owned business with great potential, we want Edwards to represent a strong set of values so that we are known for surpassing your expectations, our exceptional hard work, earned loyalty and for using our unique skills for your benefit. It also marks more focused commitment to concentrate on what we do best – providing innovative vacuum products and services across the diverse markets and regions we serve. Serving our customers safely remains our top priority.

Our new branding will begin to appear from July onwards, and will replace the BOC Edwards brand over the next 12 months. Our website and email addresses will also change to ‘edwardsvacuum’ immediately, however the previous website and email addresses will continue to operate and will automatically redirect mail and enquiries. Over the next few months, some of our local legal entity names will change to be aligned with our new name. You will be notified separately of this, although it is not expected to affect transaction processing.

We are also pleased to announce our executive management team, each with regional responsibility to further strengthen our local presence and ensure customer satisfaction.

Nigel Hunton – Chief Executive Officer

Phil Blakey – President, Americas

Alan Purvis – Managing Director, Europe

Hiroshi Kusano – President, Japan

JC Kim – President, Korea

Neil Lavender-Jones – Managing Director, Asia

Edwards is the global semiconductor and vacuum technology company you have known and trusted for nearly 100 years. Our 4,000+ skilled employees are dedicated to providing innovative technology and products, applications expertise and best-in-class operations and maintenance services. Please visit our new website – www.edwardsvacuum.com – which combines corporate, application and product materials with a greatly-improved ecommerce function.

On behalf of all of us, thank you for your loyalty and we look forward to continuing our successful business relationship with you.

Sincerely,

Nigel Hunton

Chief Executive Officer

Phil Blakey

President, Americas

Edwards customer letter www.edwardsvacuum.com

Graham Corporation Wins Record $9.5 Million Vacuum System Order for U.S. Refinery Expansion Project

Graham Corporation, BATAVIA, NY, July 9, 2007

Graham Corporation (AMEX: GHM) announced today that it has been awarded a $9.5 million purchase order for an ejector/liquid ring pump combination vacuum system for a major U.S. refinery expansion project located in the U.S. Gulf Coast region. Planned delivery is September 2008, and revenue will be recognized on percentage of completion basis. At this time, it is not anticipated that this order will contribute to current fiscal year 2008 sales.

The refinery, which produces gasoline, diesel and aviation fuel, will add over 300,000 barrels per day in additional capacity. This increase, which is equivalent to building a new refinery, will make this site the largest refinery in the U.S. and among the largest in the world. The refinery already had several pieces of Graham’s equipment in its existing operations.

James R. Lines, President of Graham Corporation, noted, “Our engineering excellence, quality product and strong reputation enabled us to win this record order. We have had a long relationship with this customer, and they are already using our equipment in their operations.”

He continued, “This expansion is representative of the significant investment being made by the oil industry in U.S. refinery operations. We believe that market fundamentals continue to support refinery expansion in the U.S. and around the world, and we intend to capitalize on this growth while focusing on the projects and customers that have the highest degree of likely success.”

Graham engineers have been working with the refiner and the engineering, procurement and construction contractor over the last 18 months to develop design options and solutions to best meet the operating objectives of the refinery. The refinery will include the latest in design and technology that will minimize emissions associated with the refining process and produce lower emission fuels.

ABOUT GRAHAM CORPORATION With world-renowned engineering expertise in vacuum and heat transfer technology, Graham Corporation is a designer, manufacturer and global supplier of ejectors, pumps, condensers, vacuum systems and heat exchangers. Over the past 71 years, Graham Corporation has built a reputation for top quality, reliable products and high-standards of customer service. Sold either as components or complete system solutions, the principal markets for Graham’s equipment are the petrochemical, oil refining and electric power generation industries, including cogeneration and geothermal plants. Graham equipment can be found in diverse applications, such as metal refining, pulp and paper processing, ship-building, water heating, refrigeration, desalination, food processing, drugs, heating, ventilating and air conditioning.

Graham’s reach spans the globe. Its equipment is installed in facilities from North and South America to Europe, Asia, Africa and the Middle East.

download the press release

For more information contact:

Graham Corporation - www.graham-mfg.com - 20 Florence Avenue Batavia, NY 14020, USA

J. Ronald Hansen, Vice President - Finance and Administration, and CFO, Tel. +1 (585) 343-2216 email: rhansen@graham-mfg.com

Deborah K. Pawlowski, Kei Advisors LLC, Tel. +1 (716) 843-3908, email: dpawlowski@keiadvisors.com

New Catalogue - Oerlikon Leybold Vacuum General Catalogue

Cologne, 28. Juni 2007

Oerlikon Leybold Vacuum new general catalogue is now available.

The 980-page volume contains everything that users and interested parties ought to know about Vacuum Technology and Oerlikon Leybold vacuum's product line, covering components such as: rotary vane-, rotary piston-, dry compressing diaphragm pumps, piston and scroll vacuum pumps, roots vacuum pumps, pump systems, turbomolecular pumps, diffusion pumps, cryo and ion sputter pumps, vacuum fittings and valves. Additional information is available on vacuum pressure gauges, leak testing instruments, turboradial blowers and high-vacuum experimentation systems. In addition to dimensional drawings and performance diagrams, the advantages for users and the typical applications are itemized. The technical specifications and ordering data are of course listed for each product. Additionally the reader will find individual maintenance and service packages of the product line.

This catalogue is also available in a CD-ROM version and in our website www.oerlikon.com/leyboldvacuum

World's Largest Vacuum Chamber to Test Orion

June 19, 2007 - NASA's Glenn Research Center

Before NASA's new spacecraft, Orion, carries the next generation of explorers into space, it first will make a shorter journey to the world's largest vacuum chamber. In this massive, cathedral-like structure, it must endure a variety of rigorous challenges.

Called the Space Power Facility, the vacuum chamber resides at NASA Glenn Research Center's Plum Brook Station in Sandusky, Ohio. It measures 100 feet in diameter and towers at 122 feet tall. Its immense size and ability to simulate the vacuum of space make it ideal for testing the Orion crew exploration vehicle.

On June 11, the facility opened its doors for a rededication ceremony. Agency managers, community stakeholders and elected officials gathered to celebrate the role this facility will play in the country's next phase of space exploration.

Making its first flights early in the next decade, Orion is part of NASA's Constellation Program to send human explorers back to the moon and then onward to Mars and other destinations in the solar system.

The fully assembled spacecraft will stand 75 feet tall and include a crew module to carry the astronauts; a service module to provide power, propulsion and communications; a launch abort system for emergency escapes; and an adapter to connect the spacecraft to its launch system.

But before NASA can launch Orion, the agency "must demonstrate that the vehicle is capable of withstanding the harsh environment of space," said Robert Moorehead, Director of Space Flight Systems at Glenn. "The Space Power Facility will help us do that."

In 2008, workers will begin modifying the building to accommodate these tests. A new vibration and acoustic test chamber, a mechanical vibration test stand and electromagnetic interference equipment will enable the facility to simulate the conditions Orion must endure on its mission.

"The Space Power Facility will be the only facility in the U.S., if not the world, that can perform complete environmental testing on a fully assembled spacecraft," said David Stringer, director of Plum Brook Station.

The new reverberant acoustic chamber will subject Orion to the intense vibrations and shockwaves it will endure during launch and ascent. In the vacuum chamber, infrared lamps and cold walls flushed with liquid nitrogen will simulate the extreme hot and cold temperatures of space. The electromagnetic interference tests will also take place inside the vacuum chamber, which blocks radio frequencies and cell phone signals. Electromagnetic interference equipment positioned on moving platforms will challenge the reliability of Orion's communications and electronics systems.

Built in 1969, the Space Power Facility has tested the International Space Station's radiator and solar arrays, the Mars rover landing systems, and most of the nation's major rockets, including Atlas and Delta. With the upgrades, the Plum Brook facility also will be well suited to test next-generation lunar landers, robotic systems, and military and commercial spacecraft.

"Plum Brook will have an important role to play in the future exploration of space," said NASA's Associate Deputy Administrator Charles Scales. "It's hard to believe that in less than two decades, people will look up and, with nothing but a strong telescope, see the shining lights of a research center on the moon."

Jan Wittry (SGT, Inc.), NASA's Glenn Research Center, www.nasa.gov

Innovative Scroll Pump from Varian, Inc. Delivers a Compact Solution to the Difficult Problem of Dry Vacuum Pumping

LEXINGTON, Mass., June 11, 2007

Varian, Inc. (Nasdaq: VARI) announced today its new compact, high performance, dry scroll pump. The innovative IDP-3 brings the proven benefits of dry scroll technology to applications where vacuum performance, pump size and environmental concerns are critical. Its small size, low noise and low power demand allow easy integration into OEM systems. This pump provides affordable oil-free vacuum for a wide variety of applications from analytical instrumentation and high energy physics to semiconductor fabrication and industrial processing.

The IDP-3 employs a hermetic design in which the motor and bearings are outside the vacuum space, allowing full isolation of all pumped gases. The benefits of this design include: lower noise and vibration levels, long-term reliability and simple maintenance requirements. The scroll pump design also minimizes the possibility of catastrophic failures such as seizing or sudden vacuum loss inherent to rotary vane or diaphragm pumps.

The IDP-3 measures 14 x 7 x 6 inches (356 x 178 x 152 mm), yet delivers a robust pumping speed of 60 L/m and a very low base pressure of less than 250 mTorr -- almost four times lower than an equivalently sized membrane/diaphragm pump. In turbo pump applications, lower base pressure reduces power consumption and bearing temperature in the turbo pump, thereby increasing reliability of the vacuum system.

The oil free design not only negates the possibility of oil contamination in the vacuum system, but it reduces the total cost of ownership by completely eliminating the cost of oil and related maintenance costs for its filling, disposal, and cleanup.

"As a compact, high performance source of dry vacuum, the IDP-3 is directly suitable for OEM instrument and vacuum system uses, as well as laboratory applications." said Sergio Piras, Senior Vice President, Vacuum Technologies, Varian, Inc. "This innovative solution expands the number of applications for which dry scroll pumps can meet the requirement for smaller primary pumps."

For more technical information about Varian's vacuum technologies, please visit http://www.varianinc.com/

Varian, Inc. is a leading worldwide supplier of scientific instruments and vacuum technologies for life science and industrial applications. The company provides complete solutions, including instruments, vacuum components, laboratory consumable supplies, software, training and support through its global distribution and support systems. Varian, Inc. employs approximately 3,800 people and operates manufacturing facilities in 13 locations in North America, Europe and Asia Pacific. Varian, Inc. had fiscal year 2006 sales of $835 million, and its common stock is traded on the NASDAQ Global Select Market under the symbol, "VARI". Further information is available on the company's Web site: www.varianinc.com.

For More Information, contact:

Public Relations, Varian, Inc., Tel. 650.424.3845

www.varianinc.com

Graham Corporation Achieves Fourth Quarter Record Earnings and 2007 Year-End Backlog

Graham Corporation, Batavia, NY, USA - June 5, 2007

- Year-end sales of $65.8 million; fourth quarter sales of $20.8 million

- Gross margin of 29.2% in fourth quarter

- Record backlog of $54.2 million and orders of $27.3 million in fourth quarter

- Net income of $5.8 million for year-end; fourth quarter net income of $3.4 million, including recognition of $1.4 million in out-of-period research and development tax credit

Graham Corporation (AMEX: GHM) today reported record earnings for its fourth quarter and year ended March 31, 2007, including recognition of a $1.4 million tax credit. Sales for the fourth quarter were $20.8 million, a 31% increase from sales of $15.9 million in the fourth quarter of the prior fiscal year. This increase was driven by continued strong demand for Graham’s vacuum systems and surface condensers for refineries and petrochemical processing plants. For the full fiscal year, sales were $65.8 million compared with $55.2 million in fiscal year 2006.

Net income for the fourth quarter was $3.4 million, or $0.86 per diluted share, compared with $1.0 million, or $0.25 per diluted share, in the same period the prior year. Net income for the year ended March 31, 2007, was $5.8 million, or $1.46 per diluted share, up from $3.6 million, or $0.96 per diluted share, for fiscal year 2006. Included in net income for the fourth quarter was the recognition of an outof- period research and development tax credit of $1.4 million, or $0.35 per diluted share. Excluding such tax credit, net income was $2.0 million for the fourth quarter of fiscal year 2007, up 110% compared with the prior year’s fourth quarter net income. Excluding the aforementioned tax credit, net income for the full fiscal year would have been $4.4 million, or $1.11 per diluted share for the full year. Going forward, the tax credit is expected to be in the range of $150 to $250 thousand per year, provided the credit is extended by Congress beyond fiscal 2007.

Record revenue growth in the fourth quarter of fiscal year 2007 was the result of sales of approximately 36% for oil refining projects, 37% for petrochemical and chemical projects and the remaining 27% for other industrial and commercial applications. With the strength of these industries and the strong recognition for Graham’s quality engineered vacuum systems and surface condensers, Graham has focused on capturing high quality opportunities by successfully addressing customers’ needs. Domestic projects accounted for 56% of total sales in the fourth quarter of fiscal 2007, while projects in the Middle East contributed 20% of sales and Asian projects contributed 19%.

Gross margin for the fourth quarter of fiscal year 2007 was 29.2%, an increase from 27.6% during the same period the prior year, and a 580 basis point sequential increase from 23.4% in the third quarter of fiscal year 2007. Higher contract prices helped to offset the volatility of material costs, a major component of the cost of goods sold. For the year ended March 31, 2007, gross margin was 25.6% compared with 28.9% for the year ended March 31, 2006.

James R. Lines, Graham’s President and COO, commented, “Our fourth quarter gross margin demonstrated the effect of our more disciplined order selection process. We concentrated earlier in the year on winning the right contracts from the right customers to best utilize engineering and manufacturing capacity in order to expand margin. During the year, we took steps to improve our production throughput and operational efficiencies by upgrading manufacturing equipment, improving production flow and successfully shifting personnel resources to areas that needed them, which we expect will help us expand our operating leverage. In addition, we increased capacity by outsourcing approximately 13% of our total production hours during the second half of the fiscal year.”

Selling, general and administrative (“SG&A”) expenses for the fourth quarter of 2007 were $3.1 million, or 14.9% of sales, compared with $2.3 million, or 14.4% of sales, in the same period the prior year. SG&A expenses remained relatively steady at $10.3 million, or 15.7% of sales, for fiscal year 2007 compared with $9.8 million, or 17.8% of sales in the prior fiscal year. Graham expects that the general range of fourth quarter SG&A should be representative of its ongoing SG&A costs.

Operating margin for the fourth quarter of fiscal year 2007 was up 100 basis points to 14.3% driven by higher sales. Operating margin improved sequentially from 6.8% in the third quarter of fiscal year 2007.

For fiscal year 2007, operating margin was 10.1% compared with 11.1% for fiscal year 2006.

Fiscal Year 2007 Sales Review

Approximately 52% of the fiscal year 2007 sales increase was a result of greater exports to Asia and the Middle East for petrochemical and refinery projects. Sales for fiscal year 2007 by geographic region were approximately 54% to North America, 23% to the Middle East, 17% to Asia and 6% to the other regions of the world. Fiscal year 2006 sales were 60% to North America, 16% to Asia, 14% to the

Middle East and 10% to the rest of the world. Sales for fiscal year 2007 by market were approximately 39% for petrochemical and chemical projects, 35% for oil refinery projects, 5% for power projects and the remaining 21% for other industrial or commercial applications. For fiscal 2006, net sales by market were approximately 42% for oil refinery projects, 24% for chemical and petrochemical projects, 14% for power projects and the remaining 20% of net sales were for other applications.

Sales increased in all product categories in fiscal year 2007 compared with fiscal year 2006 with the largest increases coming from the ejector, heat exchanger and vacuum pump product lines. Ejector systems made up approximately 26% of the increase as a result of higher sales to the oil refining industry for plant upgrades and capacity expansion projects. Higher heat exchanger sales contributed 31% to the sales growth as a result of a broad-based internal strategic effort, including training, manufacturing improvements, supplier changes and the addition of marketing tools and an expanded agency network. Vacuum pump sales accounted for 15% of the sales growth due to higher demand for domestic refinery applications.

Balance Sheet and Cash Management

Cash, cash equivalents and investments at March 31, 2007 were $15.1 million compared with $11.0 million at March 31, 2006. Net cash provided by operating activities was $5.2 million for fiscal year 2007 compared with $6.5 million for the previous fiscal year. A higher accounts receivable balance at March 31, 2007 of $11.9 million compared with $6.0 million at March 31, 2006 reflected the timing of various progress billing stages of contracts. Customer advance payments in excess of inventory in-progress increased to $6.1 million at March 31, 2007 compared with $1.6 million at March 31, 2006.

Capital expenditures were $1.6 million for fiscal year 2007 compared with $1.0 million during fiscal year 2006. Capital expenditures were primarily used for investments in upgrading manufacturing and production equipment to increase throughput and efficiency while reducing required manpower. Additional investments were made for information technology and software improvements in engineering, marketing and administrative areas.

download the FINANCIAL TABLES

For more information contact:

Graham Corporation - www.graham-mfg.com - 20 Florence Avenue Batavia, NY 14020, USA

J. Ronald Hansen, Vice President - Finance and Administration, and CFO, Tel. +1 (585) 343-2216 email: rhansen@graham-mfg.com

Deborah K. Pawlowski, Kei Advisors LLC, Tel. +1 (716) 843-3908, email: dpawlowski@keiadvisors.com

Changes in the Management Board at Pfeiffer Vacuum Technology AG

Pfeiffer Vacuum Technology AG, Asslar, Germany - June 1, 2007

Record dividend pleases Pfeiffer Vacuum shareholders.

Top management shares outlook for the full 2007 fiscal year.

Changes in the Management Board.

This year’s Annual Shareholders Meeting of Pfeiffer Vacuum Technology AG, a leading manufacturer of high-quality vacuum pumps, vacuum gauges and complete vacuum systems, was held on May 31, 2007, at the Stadthalle in Wetzlar. The presence level of 58 percent at the Annual Shareholders Meeting was up strongly by comparison with the year before. Chairman of the Supervisory Board Dr. Michael Oltmanns was pleased to welcome over 400 shareholders, as well as representatives from shareholder associations and banks. Chief Executive Officer Wolfgang Dondorf and Chief Financial Officer Manfred Bender reviewed the recordsetting 2006 fiscal year and offered up an outlook for the year 2007, which has gotten off to a highly successful start. Sales of € 195 to € 200 million were cited as the target for the full fiscal year, with an EBIT margin of at least 25 percent. All questions from shareholder representatives and individual shareholders relating to individual numbers in the financial statements, markets and the competitive situation, the company’s listing on the New York Stock Exchange, the stock buyback program, dividend policy and the planned expansion of the manufacturing facility at the Asslar location were answered in detail within the framework of the question and answer session.

In the subsequent voting, the actions of the Management and Supervisory Boards were ratified by more than 99 percent of the votes cast. Shareholders had every reason to be very satisfied about the significantly higher distribution: A dividend in the amount of € 2.50 per dividend-entitled share of stock will be paid to shareholders from retained earnings. This means that nearly 75 percent of the company’s net profit is being distributed to its shareholders, representing an increase of 85 percent over the year before. Agenda Item 7 – Amendment of the company’s articles of association and bylaws relating to resolutions requiring a three-quarters majority – did not achieve the required majority. All further resolutions on the agenda passed with sweeping majorities. They included amendments to the company’s articles of association and bylaws, the authorization of a further stock buyback program and the reelection of Ernst & Young as the company’s independent auditor. Wolfgang Dondorf, who has served as the company’s chief executive officer since it went public in 1996, announced that he would be stepping down from this post at the age of 63 effective June 30, 2007, and passing on the baton to younger leadership. This change is taking place within the framework of long-term succession planning. Supervisory Board Chairman Dr. Michael Oltmanns paid tribute to the remarkable contribution that Wolfgang Dondorf has made to the Pfeiffer Vacuum Technology AG success story, and thanked him for his vigor, enthusiasm and commitment. Wolfgang Dondorf had this to say about his retirement: “I am proud that the company is in such good shape and that the Supervisory Board has followed my recommendation to appoint Manfred Bender as the new chief executive officer. Manfred Bender has been with Pfeiffer Vacuum for nine years and has served as chief financial officer for the past three years. Together with Dr. Matthias Wiemer, who has been with Pfeiffer Vacuum since October 2005 and was appointed to the Management Board effective April 1, 2007, as chief operating officer, he will continue to expand the company and keep it on its success track – to the benefit of its customers, its employees and its shareholders.”

The presentations by the members of the Management Board as well as detailed information relating to the results of the voting are available on the company’s Internet site at www.vacuum-guide.com/shareholders_meeting. (Press Release)

Pfeiffer Vacuum Technology AG - www.pfeiffer-vacuum.com

Gudrun Geissler, Investor Relations, Tel. +49 (0) 6441 802 314, Fax +49 (0) 6441 802 365

ANGSTROM SCIENCES appoints new sales manager

Pittsburgh, PA, April 25, 2007

Angstrom Sciences, Inc. today announced the appointment of Mark J. Seeman to the position of Sales Manager. Mr. Seeman will report directly to Mark A. Bernick, President of Angstrom Sciences. He will be responsible for managing the company's worldwide distribution network and shaping the overall sales strategy of the company.

Mr. Seeman comes from a thirteen-year tenure at Advanced Energy, Inc. as an account manager, engineering technician, and lead production technician. His superior understanding of vacuum science and technology has provided clients from small universities to Fortune 500 companies with expert advice, support, and service. Mr. Bernick commented, "Mark Seeman possesses the perfect combination of executive management skills and customer-centric philosophies that will help Angstrom Sciences achieve the next level of customer support and service. We are very excited to have him join our team as we move into our second decade of providing custom magnetron sputtering cathodes in a high technology industry."

Angstrom Sciences is the world leader in magnetron technology used to produce thin films through the "sputtering" process. Sputtering is used to manufacture advanced products, such as compact disks, energy efficient architectural glass, OLED technology, solar panels, flat panel displays and microelectronic devices. The company has a worldwide business presence and is headquartered in Pittsburgh, PA.

For more information on magnetron sputtering technology, visit Angstrom Sciences at www.angstromsciences.com.

CCMP Capital agrees to acquire BOC Edwards’ Vacuum and Semiconductor Equipment Business

March 12, 2007 — CCMP Capital, through affiliates of CCMP Capital Advisors LLC and CCMP Capital Asia, Ltd., premier international private equity firms, have reached agreement with The Linde Group, the global gases company, to acquire BOC Edwards, a leading manufacturer of vacuum equipment. The deal is valued at €685m (£460m)*, with an additional payment of €65m (£45m) if CCMP Capital is successful in developing the business and subsequently exiting its investment.

BOC Edwards is a leading global supplier of equipment and services to the world’s most advanced industries, including semiconductor, flat panel display, chemical, metallurgical, analytical instrumentation and R&D. It supplies major manufacturers in Asia, Europe and the Americas through a worldwide manufacturing and sales network.

The acquisition follows last year’s acquisition of The BOC Group by Linde and Linde’s announcement last September that it intended to focus on its global gases operations and would review strategic options for the divestment of BOC Edwards.

CCMP Capital Advisors and CCMP Capital Asia are acquiring the main vacuum and semiconductor equipment business of BOC Edwards. The pharmaceutical division will remain a subsidiary of The Linde Group.

Commenting on the announcement Nigel Hunton, Chief Executive of BOC Edwards, said: “We are delighted to welcome CCMP as our new partners. We feel they have a real understanding for our business and its potential and that their financial strength and scale will support the company as we develop our operations worldwide and capitalise on our strong market position. This is the start of a new independent era for BOC Edwards in which we can focus on delivering world class products and services to our customers.”

Stephen Welton from CCMP Capital Advisors added: “We are very pleased to have reached agreement to acquire BOC Edwards. Our Diligence has confirmed the leading position of BOC Edwards, its management and staff, its extensive product range and its strong customer relationships. We believe that under CCMP’s ownership BOC Edwards can move to a new level as an independent company and develop its technology in new markets whilst retaining leadership in its core areas.”

John Lewis from CCMP Capital Asia, commented: “BOC Edwards is an outstanding business with a rapidly growing Asian customer base, including leading semiconductor companies and equipment manufacturers in Greater China, Korea, Japan and Singapore. We will support management, using CCMP’s presence and experience in these markets to help BOC Edwards get closer to their fast growing Asian customer base.”

The companies expect to close the transaction between the beginning of May and the end of June subject to regulatory review and customary closing conditions. Financing for the transaction will be provided by Deutsche Bank, Lehman Brothers, Barclays Bank, and The Royal Bank of Scotland. Lehman Brothers is serving as the exclusive mergers and acquisitions advisor to CCMP Capital.

* Based on an exchange rate of 1.473 £/€

About BOC Edwards

BOC Edwards is a leading supplier of integrated solutions for the manufacture of microelectronics devices, including semiconductors and flat panel displays. It is also a world leader in vacuum technology for industrial, scientific, process, and R&D applications. BOC Edwards employs around 4,000 people globally, in the design, manufacture and support of high technology vacuum equipment. BOC Edwards invented the concept of the commercial oil-free ‘dry’ vacuum pump and now supplements this with a wide range of other pumping technologies as well as related products and services.

About CCMP Capital Advisors

The investment team of CCMP Capital Advisors, LLC has invested over $10 billion in over 375 buyout and growth equity transactions since 1984. The foundation of CCMP Capital's investment approach is to leverage the combined strengths of its deep industry expertise and proprietary global network of relationships by focusing on five targeted industries: Consumer, Retail and Services; Energy; Healthcare Infrastructure; Industrials; and Media and Telecom. Through active management and its powerful value creation model, CCMP Capital's team has established a reputation as a world-class investment partner.

Selected investments include: AMC Entertainment, Aramark Corporation, Generac Power Systems, Grupo Corporativo ONO, Hanley Wood, Harbor Point Re, PQ Corporation, Quiznos Sub, SafetyKleen Europe and Warner Chilcott.

Prior to forming CCMP Capital, the firm's principals led the buyout and growth equity investment business of J.P. Morgan Partners, LLC, a private equity division of JPMorgan Chase & Co. CCMP Capital follows the successful investment strategy its principals developed and implemented as members of JPMorgan Partners.

CCMP Capital is a registered investment adviser with the Securities and Exchange Commission.

About CCMP Capital Asia

CCMP Capital Asia, Ltd. is one of the largest and most experienced buyout firms in Asia, with US$2.7 billion in capital commitments under management. Since its launch in May 1999, CCMP Capital Asia has advised on total investment commitments of over US$1.6 billion in 24 companies with total transaction value of over US$10 billion. The commitments are spread across Asia in CCMP Capital Asia’s focus markets of Australia, Greater China, Japan, Korea and Singapore. CCMP Capital Asia’s core strategy is to target control investments in market leading companies with strong cash generative business models, high barriers to entry and differentiating capabilities or products. In particular, the Firm focuses on companies where it is able to utilize its operationally driven business model to create value and drive returns.

Representative investments include: Air International Thermal, ASAT, Buy The Way, Godfrey’s, Haitai Confectionary, Mando Corporation, Metalform, Rhythm Corporation, Sanda Kan Industrial, Waco and Yellow Pages Singapore.

Enquiries:

BOC Edwards, The Maitland Consultancy Ltd

Neil Bennett, Amanda Martyr, Tel. +44 20 7379 5151

CCMP Capital Advisors, LLC

Neil Bennett, Amanda Martyr, Tel. +212 600 9657

Gavin Anderson & Company

Richard Barton, Joshua Goldman-Brown, Tel. +852 2523 7189

more links

|

Linde Sells BOC Edwards Unit to CCMP

Houston Chronicle, TX, Mar. 13, 2007 © 2007 AP. FRANKFURT, Germany — Linde AG, the world's biggest producer of industrial gases, said Monday it sold part of its BOC Edwards subsidiary to ... more |

|

Linde sells BOC to buyout specialist

EETimes.com, SAN JOSE, Calif., Mar. 13, 2007 The Linde Group Monday (March 12) announced plans to sell the semiconductor equipment arm of BOC Edwards to private-equity buyout ... more |

|

Linde Sells BOC Edwards Unit to CCMP

Forbes, NY, Mar. 12, 2007 AP 03.12.07, 12:14 PM ET. Linde AG, the world's biggest producer of industrial gases, said Monday it sold part of its BOC Edwards subsidiary to private ... more |

|

Linde Sells Components Unit to CCMP for EU685 Million (Update3)

Bloomberg, By Stefanie Haxel, Mar. 12, 2007 Linde Group, the world's biggest maker of industrial gases, sold a components unit to private- equity firm CCMP ... more |

SCHWARZER PRECISION SP 135 FZ – worldwide smallest vane pump

SP 135 FZ – small size is really great

With the SP 135 FZ Schwarzer Precision presents an advancement in the further development of the smallest vane pump worldwide. Due to new materials it has become even more robust and a higher level of running smoothness has been achieved. Because of the almost pulsation-free pumping process the SP 135 FZ is ideal for applications in respiratory gas analysis. Maximum flow-rate is 700 ml/min, pressure 60 mbar, and vacuum -60 mbar. The linear characteristic of the flow-voltage relation allows an extremely precise regulation. And with its minimum power consumption in combination with minimum dimensions and a weight of only 12 g the SP 135 FZ offers optimum conditions for the use in portable devices.

SCHWARZER PRECISION - www.schwarzer.com - Steeler Str. 477, 45276 Essen, Deutschland

Vera Schwarzer, email: info@schwarzer.com, Tel. 0201 316970, Fax 0201 316970

Neuheiten

Neuheiten

Actualité

Actualité

Your Press Release

Are you lauching a new product ? Did your company built a new plant ? delivered an important piece of equipment? agreed to a distribution agreement ? ...

Publish your article, post your news release, email now to: info@vacuum-guide.com

Your Diary

conferences, meetings, exhibitions